Scénario de trading : que se passe-t-il si vous tradez avec seulement 100 $ ?

Partager sur FacebookPartager sur Twitter

Que se passe-t-il si vous ouvrez un compte de trading avec seulement 100 $ ?

Ou 100 € ? Ou 100 £ ?

Étant donné que le trading sur marge vous permet d’ouvrir des transactions avec seulement une petite somme d’argent, il est certainement possible de commencer à trader le Forex avec un dépôt de 100 $.

Mais devriez-vous le faire ?

Voyons ce qui peut arriver si vous le faites.

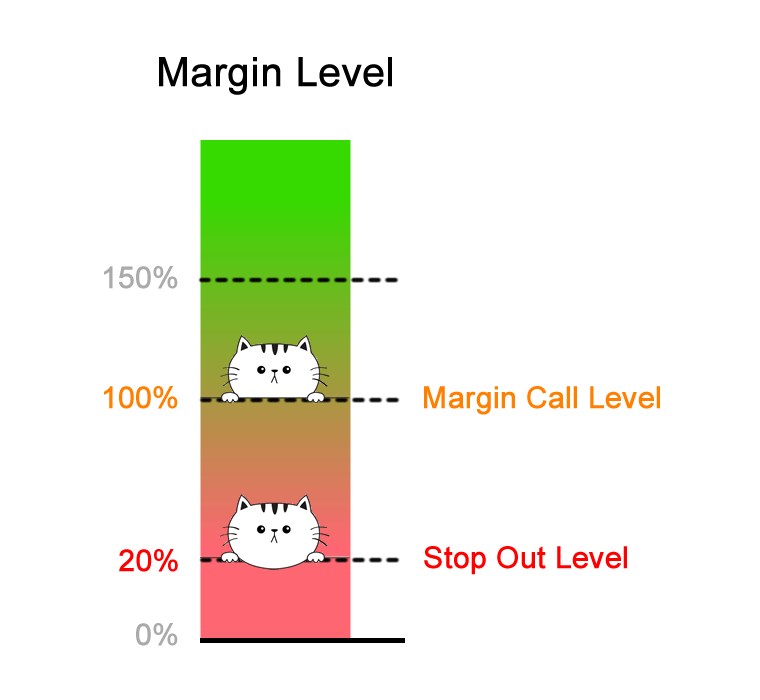

Dans ce scénario de trading, votre courtier Forex de détail a un niveau d’appel de marge de 100 % et un niveau de stop out de 20 % .

Maintenant que nous savons ce que sont les niveaux d’appel de marge et de stop out, découvrons si le trading avec 100 $ est faisable.

Si vous n’avez pas lu nos leçons sur les niveaux d’appel de marge et de stop out, mettez cette leçon en pause et commencez ici en premier !

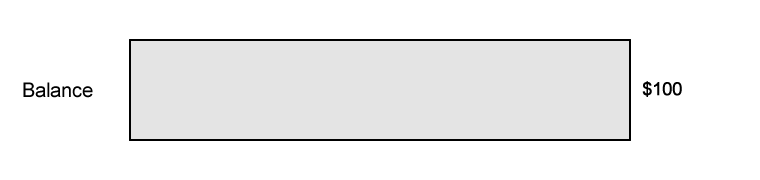

Étape 1 : Déposer des fonds sur le compte de trading

Étant

donné que vous êtes un grand joueur, vous déposez 100

$ sur votre compte de trading.

Étant

donné que vous êtes un grand joueur, vous déposez 100

$ sur votre compte de trading.

Vous avez maintenant un solde de compte de 100 $.

Voici à quoi cela ressemblerait sur votre compte de trading :

| Long / Court | Paire de devises | Taille de la position | Prix d’entrée | Prix actuel | Niveau de marge | Équité | Marge utilisée | Marge libre | Équilibre | P/L flottant |

| – | 100 $ | – | 100 $ | 100 $ | – |

Étape 2 : Calculer la marge requise

Vous souhaitez ouvrir une position courte sur l’EUR/USD à 1,20000 et souhaitez ouvrir une position de 5 micro-lots (1 000 unités x 5). La marge requise est de 1 % .

De quelle marge (« marge requise ») aurez-vous besoin pour ouvrir la position ?

Étant donné que notre compte de trading est libellé en USD, nous devons convertir la valeur de l’EUR en USD pour déterminer la valeur notionnelle de la transaction.

1 € = 1,20 $ 1 000 € x 5 micro-lots = 5 000 € 5 000 € = 6 000 $

La valeur notionnelle est de 6 000 $ .

Nous pouvons maintenant calculer la marge requise :

Marge requise = Valeur notionnelle x Exigence de marge 60 $ = 6 000 $ x 0,01

En supposant que votre compte de trading soit libellé en USD puisque l’exigence de marge est de 1 % , la marge requise sera de 60 $ .

Étape 3 : Calculer la marge utilisée

Hormis la transaction dans laquelle nous venons de conclure, il n’y a pas d’autres transactions ouvertes.

Étant donné que nous n’avons qu’une seule position ouverte, la marge utilisée sera la même que la marge requise .

Étape 4 : Calculer les capitaux propres

Supposons que le prix ait légèrement évolué en votre faveur et que votre position se négocie désormais à l’équilibre .

Cela signifie que votre P/L flottant est de 0 $ .

Calculons votre équité :

Equity = Balance + Floating Profits (or Losses) $100 = $100 + $0

The Equity in your account is now $100.

Step 5: Calculate Free Margin

Now that we know the Equity, we can now calculate the Free Margin:

Free Margin = Equity - Used Margin $40 = $100 - $60

Step 6: Calculate Margin Level

Now that we know the Equity, we can now calculate the Margin Level:

Margin Level = (Equity / Used Margin) x 100% 167% = ($100 / 60) x 100%

The Margin Level is 167%.At this point, this is how your account metrics would look in your trading platform:

| Long / Short | FX Pair | Position Size | Entry Price | Current Price | Margin Level | Equity | Used Margin | Free Margin | Balance | Floating P/L |

| – | $100 | – | – | $100 | – | |||||

| Short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080. Let’s see how your account is affected.

Used Margin

You’ll notice that the Used Margin has changed.

Because the exchange rate has changed, the Notional Value of the position has changed.

This requires recalculating the Required Margin.

Whenever there’s a change in the price for EUR/USD, the Required Margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much Required Margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the Notional Value of the trade.

€1 = $1.2080 €1,000 x 5 micro lots = €5,000 €5,000 = $6,040

The Notional Value is $6,040.Previously, the Notional Value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s Notional Value to increase.

Now we can calculate the Required Margin:

Required Margin = Notional Value x Margin Requirement $60.40 = $6,040 x .01

Notice that because the Notional Value has increased, so has the Required Margin.

Since the Margin Requirement is 1%, the Required Margin will be $60.40.

Previously, the Required Margin was $60.00 (when EUR/USD was trading at 1.20000).

The Used Margin is updated to reflect changes in Required Margin for every position open.

In this example, since you only have one position open, the Used Margin will be equal to the new Required Margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a Floating Loss of $40.

Floating P/L = (Current Price - Entry Price) x 10,000 x $X/pip $40 = (1.2080 - 1.20000) x 10,000 x $0.50/pip

Equity

Your Equity is now $60.

Equity = Balance + Floating P/L $60 = $100 + (-$40)

Free Margin

Your Free Margin is now $0.

Free Margin = Equity - Used Margin -$0.40 = $60 - $60.40

Margin Level

Your Margin Level has decreased to 99%.

Margin Level = (Equity / Used Margin) x 100% 99% = ($60/ $60.40) x 100%

The Margin Call Level is when Margin Level is 100%.

Your Margin Level is still now below 100%!

At this point, you will receive a Margin Call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the Margin Level rises above 100%.

Account Metrics

This is how your account metrics would look in your trading platform:

| Long / Short | FX Pair | Position Size | Entry Price | Current Price | Margin Level | Equity | Used Margin | Free Margin | Balance | Floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| Short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| Short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used Margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much Required Margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the Notional Value of the trade.

€1 = $1.21760 €1,000 x 5 micro lots = €5,000 €5,000 = $6,088

The Notional Value is $6,088.

Now we can calculate the Required Margin:

Required Margin = Notional Value x Margin Requirement $60.88 = $6,080 x .01

Notice that because the Notional Value has increased, so has the Required Margin.Since the Margin Requirement is 1%, the Required Margin will be $60.88.

Previously, the Required Margin was $60.40 (when EUR/USD was trading at 1.20800).

The Used Margin is updated to reflect changes in Required Margin for every position open.

In this example, since you only have one position open, the Used Margin will be equal to the new Required Margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a Floating Loss of $88.

Floating P/L = (Current Price - Entry Price) x 10,000 x $X/pip -$88 = (1.21760 - 1.20000) x 10,000 x $0.50/pip

Equity

Your Equity is now $12.

Equity = Balance + Floating P/L $12 = $100 + (-$88)

Free Margin

Your Free Margin is now –$48.88.

Free Margin = Equity - Used Margin -$48.88 = $12 - $60.88

Margin Level

Your Margin Level has decreased to 20%.

Margin Level = (Equity / Used Margin) x 100% 20% = ($12 / $60.88) x 100%

At this point, your Margin Level is now below the Stop Out Level!

Account Metrics

This is how your account metrics would look in your trading platform:

| Long / Short | FX Pair | Position Size | Entry Price | Current Price | Margin Level | Equity | Used Margin | Free Margin | Balance | Floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| Short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| Short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| Short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop Out!

The Stop Out Level is when the Margin Level falls to 20%.

At this point, your Margin Level reached the Stop Out Level!

Your trading platform will automatically execute a Stop Out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your Used Margin will be “released”.

- Your Floating Loss will be “realized”.

Your Balance will be updated to reflect the Realized Loss.

Now that your account has no open positions and is “flat”, your Free Margin, Equity, and Balance will be the same.

There is no Margin Level or Floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / Short | FX Pair | Position Size | Entry Price | Current Price | Margin Level | Equity | Used Margin | Free Margin | Balance | Floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| Short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| Short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| Short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of Netflix!

You’ve lost 88% of your capital.

% Gain/Loss = ((Ending Balance - Starting Balance) / Starting Balance) x 100% -88% = (($12 - $100) / $100) x 100%

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (See real-time EUR/USD volatility on MarketMilk™)

Since your account balance is too low to open any new trades, your trading account is pretty much

dead.